Is it possible to get guaranteed approval when applying for bad credit car loans? Non-conventional lenders, just like traditional banks and lenders will investigate your credit history and finances in a bad credit auto loan application. However, unlike regular banks, they tend to understand your situation more and could give you a second chance for a car loan – something regular banks and lenders do not offer for people with bad credit. Guaranteed approval is a different story, but it is not impossible.

You can increase your chances of getting a guaranteed approval for a bad credit car loan by making you a viable client. Here are 11 of the top tips you can follow to be able to guarantee faster approval for your car loan.

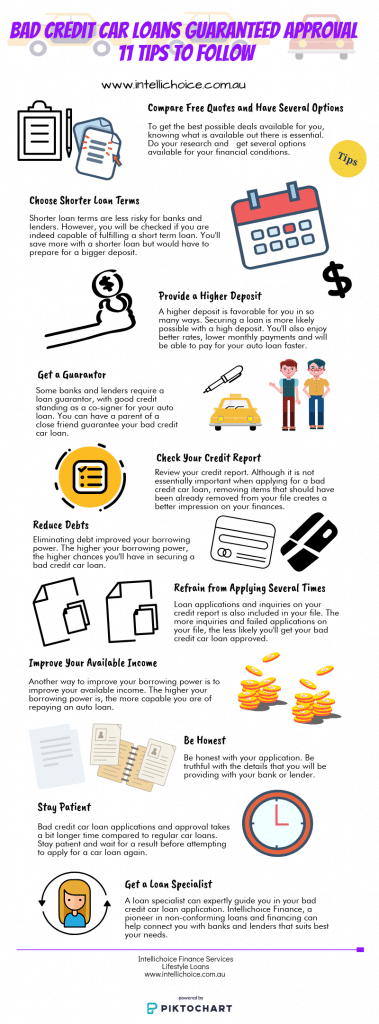

11 Tip to Increase Your Chances in Bad Credit Car Loan Guaranteed Approval

1. Compare free quotes and get several options

There are many online bad credit car loan companies that offer free quotes that can give you an idea of how much a car loan would cost you. Free quotes can also give you more idea on how to gauge each of the quotes that you receive and pick one that best suits your needs and your budget.

2. Choose shorter loan terms

Shorter loan terms can give you lower interest rates, both in a regular car loan and a bad credit car loan. The faster you pay for your approved bad credit car loan, the faster you build your credit as well. However, you should be able to estimate if what you earn during this period is enough to repay a loan while paying for other financial duties. The lender will also check the possibility of you being able to fulfill a shorter loan or not.

3. Provide a higher deposit or down payment

Even with regular car loans, a higher deposit or down payment can lower your monthly car amortization as well as lower your interest rates. Save as much as six months, or more, of your possible monthly car payment if you can. This will also create an impression that you will be able to afford to repay for your bad credit loan.

4. Get a cosigner

A co-signer with a good credit score can increase the chances of approving your bad credit car loan. This, most of the time can be a parent. Remember that your co-signer has shared financial responsibilities as you have if you fail to pay for your monthly amortizations.

5. Check your credit report

Although your credit report does not play a very significant role in getting your bad credit car loan approved, it is still a financial document accessed by non-conforming lenders to be able to determine your capacity to repay car finance. Checking your credit report allows you to remove items that should not be in your credit report anymore. Due payments and other financial obligations that you should be paying on time – to improve and build your credit history – can also be accessed from your credit report.

6. Reduce credit debts

Reducing credit debts can also increase the chances of getting a guaranteed bad credit car loan approval. In the event of loan approval, you will need to pay for your monthly car amortization, together with your personal expenses plus your other financial obligations. Getting rid of your credit debts, prior to applying for a loan gives you extra financial resources that can be allocated for paying your car loan.

7. Refrain from applying several times

It would be ideal to limit your number of applications for a car loan. Credit queries are posted on your credit history. The more attempts you have, the less likely you’ll get guaranteed approval. Review your credit history thoroughly and improve in the areas where you can improve prior to application. If bankruptcy or default is due to be removed from your credit report, it is also advisable to wait for the item to be removed before proceeding with a bad credit application.

8. Improve your income source and job criteria

It would be ideal to be a regular employee for 6 months or more in your current job before applying for a car loan. A stable source of income makes a car loan approval possible for you, even with a black mark on your credit history.

9. Get a loan specialist

A loan specialist can do wonders on your loan applications. With years of experience and a direct line to banks and lenders, it would be easier to get access to non-conforming lenders fit for your financial capabilities. A loan specialist can also guide you through the process of getting the right documents and the actual procedure in applying for a bad credit loan.

10. Be truthful with your application

Give factful information about your financial details when applying for any type of loan. Setting the facts straight does not only give you better chances of securing a loan. It also gives you a better understanding if you are indeed capable of repaying for a loan.

11. Be patient

Loan approvals may take time. It is better to wait than to suffer from an immediate rejection. Be patient and keep in touch with your loan specialist for updates and developments on your application.

Getting a bad credit car loan approved is a process. It takes time and effort to ensure that your application is a success. Follow these tips and get your dream car through car financing. Better yet, call Intellichoice for assistance.